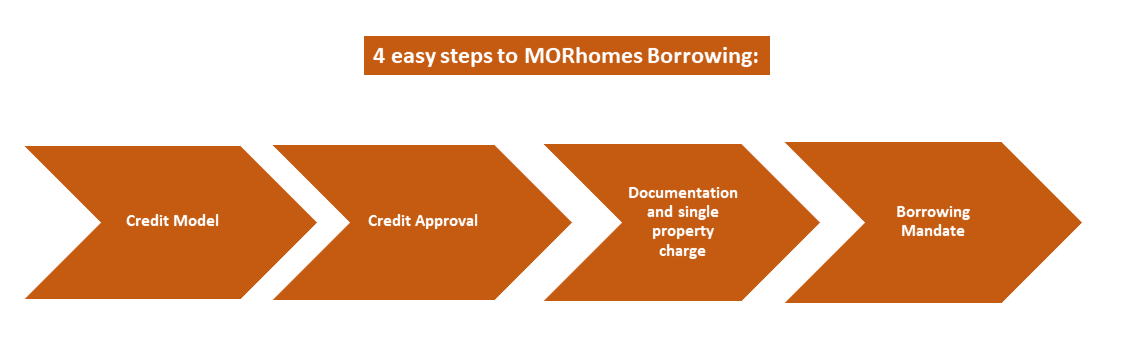

There are a few easy steps in the process, as follows:

Step 1: Credit Model

This process involves population of the spreadsheet with 5 years historic figures, and the next 5 years from your FFR Regulatory Return or equivalent (should take no more than 2 hours).

NB: As with the FFR, the information should be provided at Group level.

Please also send us the last 4 sets of audited consolidated financial accounts of the Group (If these are not available (eg the Group as such did not exist going back 5 years) we are able to take other information).

Step 2: Credit Approval

This involves MORhomes preparing a credit report and taking it to Credit Committee to approve your credit level.

You submit the credit model and provide any comments on key issues that could impact the credit outcome or provide additional supporting information.

Following this we will arrange for our Credit Team to produce a first draft Credit Report and then follow-up with a phone call (1 hour max.) to cover off any areas that require more information.

This report is then submitted via the MORhomes team to the Credit Committee for approval.

The successful credit limit is set and is valid for next 12 months – subject to no material adverse change – with an annual review thereafter.

We also ask at this stage (if available) for your potential appetite for debt and any potential restrictions on borrowing through MORhomes including:

- Amount (the Credit Model will produce your upper limit).

- When is the funding needed/desired.

- Any preferred Maturity (or range or any dates you’d wish to avoid).

- Borrowing entity within your Group (NB: The MORhomes Shareholder does not have to be the Borrower).

The cost for the process is £5,000.

NB: There is no commitment to borrow at this stage.

Step 3: Documentation (Standby Liquidity Agreement) and single property charge

The format of the loan documents has already been agreed by the Borrowers Advisory Group (and used in the first issue).

The Standby Liquidity Agreement enables you to have all the documents signed and ready to execute, held in escrow by Devonshires acting for MORhomes. This enables you to access the market at very short notice.

The cost of the Standby Liquidity Agreement is £35,000 (NB: This £35k is offset against the issuance costs when you draw down the loan).

There is also an agreement in place with Trowers & Hamlins to act on your behalf for a very competitive fee which we have negotiated on your behalf (should you wish to use them).

Our loan agreement allows you up to 12 months after drawdown to get full security in place, with a minimum of just one unit to be charged at drawdown.

We have an arrangement with Addleshaw Goddards to complete initial security charging of one property for a modest fee, usually within a two-week period.

We have also come up with a ground-breaking new initiative which can dramatically reduce the cost and time taken to put the full security in place.

NB: You need to be a Shareholder before proceeding to borrow

At this stage there is no commitment to borrow or to any other MORhomes costs other than the above costs, which are not refundable should you not proceed.

Step 4: Borrowing mandate

Once the Standby Liquidity Agreement is in place, we will be in regular contact with you over your borrowing requirements.

When you are ready to borrow you will confirm the mandate for MORhomes to go to the market and raise funds.

The mandate will be subject to key parameters on the loan including:

- Amount

- Maturity

- Maximum interest rate

- When funds required

Upon receipt we will approach our dealers to find Investors for the debt. Our target is to price within two weeks, with drawdown and release of funds one week after pricing.

The borrowing mandate commits you to borrowing (subject to the above parameters) and to issuance costs even if the transaction is not executed.